The wheels of the economy are starting to turn again as the end of lockdown looms. How your business can operate and thrive in a contactless environment will depend on your ability to harness technology.

So, let’s have a quick look at the current information on how food and retail can operate under Level 3.

From the covid19.govt.nz website (the bold emphasis is mine):

Retail and hospitality businesses can only open for delivery and contactless pre-ordered pick-up – customers cannot enter stores

Your business must be contactless. Your customers can pay online, over the phone or in a contactless way. Delivery or pick-up must also be contactless.

https://covid19.govt.nz/alert-system/alert-level-3/

NZ Herald reports:

There can’t be any contact with the public. That means retail has to be contactless purchase and delivery, such as drive-through or click-and-collect.

Shopfronts can’t be open to customers, with the exception of supermarkets, dairies and petrol stations.

https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12325855

First off, if you already have a merchant account or a Point of Sale (POS) system, then start there. Get in touch with your bank and/or EFTPOS provider to find out what options you can access from their service, be that an app or a card not present payment authority.

Secondly, for the purpose of these scenarios I have assumed that:

- Your business meets all the other requirements (hygiene, distancing etc) of Level 3.

- You’re prepared for fees (at minimum for your payment provider) and have set your prices accordingly.

All payment providers will charge you fees, it’s a part of doing business.

Scenario 1: Food & Drink Vendors

Lots of small orders with a very short turnaround time to pick-up, unlikely to have their own website.

- Mobile coffee cart

- Bakeries

- Cafe’s

- Takeaway shops

These small businesses could take phone orders but none have online payment processing so how are they going to get the payment?

SOLUTIONS:

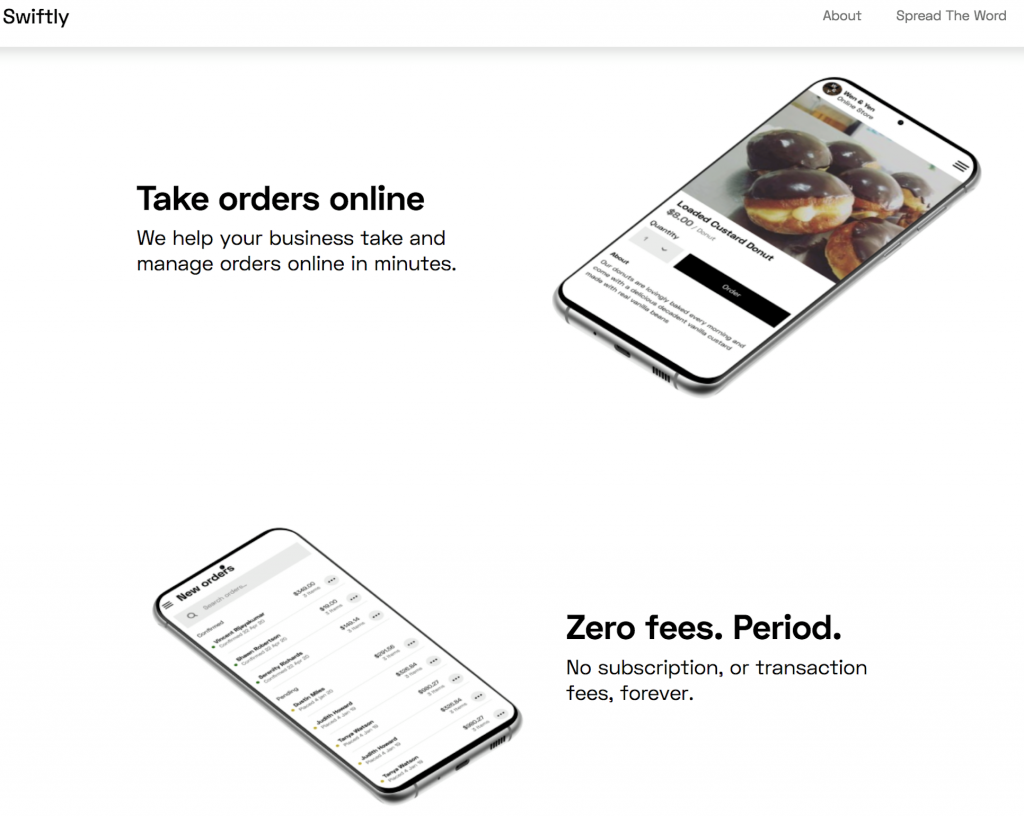

Swiftly

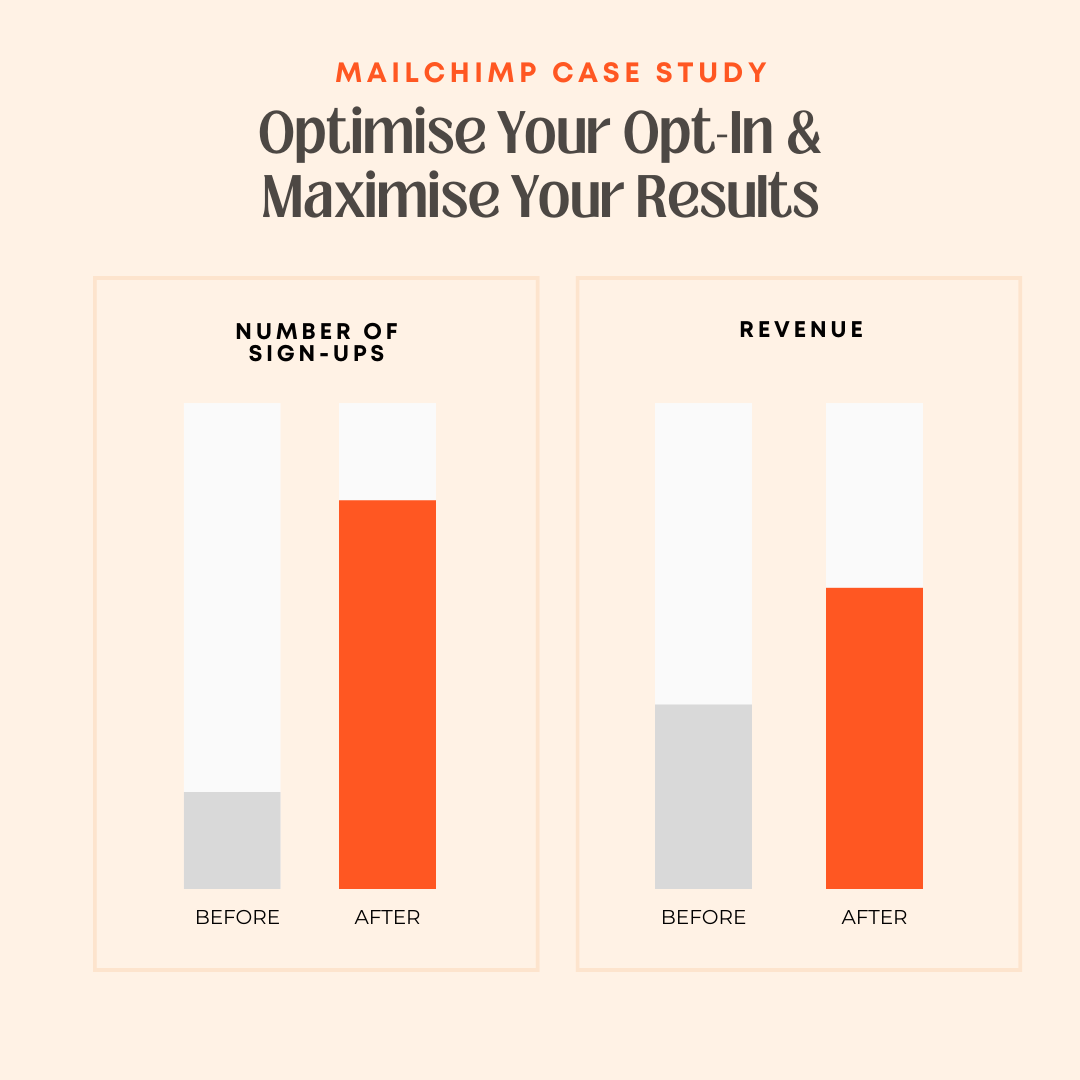

Swiftly is a NZ initiative to get business back up and running at Level 3 and beyond. It doesn’t include a payment gateway but it’s a free, lightweight store that companies can set up for online click and collect in minutes.

I put that claim to test and can confirm it took me less than 7 minutes to set up a store, add products, and place an order. Amazing work.

ServeMe App

I like that it’s really easy for customers note any special requirements on each menu item.

The Takeaway option offers the following features:

- Customers have everything they need at their fingertips with instant access to a professionally presented menu and the convenience of ordering directly through the ServeMe app.

- Staff will find the streamlined process of receiving orders and providing text message updates effortless.

- Customers can view your menu at their leisure.

- Customers can order their own takeaway meals.

ServeMe doesn’t include a payment gateway but is designed to improve your efficiency and meet stricter distancing requirements in the weeks and months to come after Level 3 ends. With features like paperless menu and request service.

On The Go App

On The Go providers your customers an enjoyable end to end experience. Grow customer spend through your new online business and track analytics through a customised Dashboard.

On the Go uses Stripe Connect as its payment system. Receive secure, on time payments all paid through the customers mobile or desktop and it also includes a whizzy self-delivery that ensures you maintain quality control right to the end point without the huge third party fee

https://www.onthegoapp.co.nz/businesses

Safe Hands Initiative

The Safe Hands Initiative is a cost-effective cloud-based solution from posBoss, helping you to confidently trade in a safe and healthy way by offering your customers access to your menu through mobile ordering and contactless payment (Click and Collect).

The Safe Hands Initiative can get you up and running in under a day – to help you continue trading whilst maintaining and encouraging social distancing during COVID-19 restrictions.

Upfront – $29 per month + GST, which pays for your posBoss Small plan and gets you Regulr and Paperless for free (Usually +$70 per month).

https://www.safehandsinitiative.cloud/

Scenario 2: Speciality Food

Made to order or speciality items with a longer turnaround to pick up time, they likely have a brochure website already and now want to take online orders and payment.

- Cake shop

- Butcher

- Green grocer

- Delis

SOLUTION:

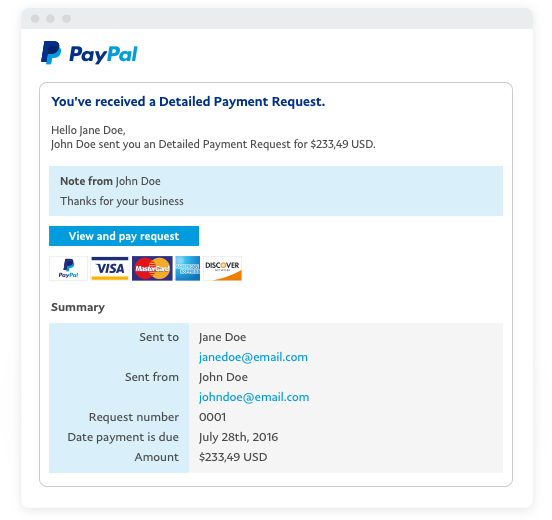

Paypal

One of the simplest methods is to get up and running with a Paypal account. All you need from the customer is an email address and you can send them a payment request or invoice which they can pay using a credit or debit card. You’re both notified by email all the way through the transaction.

Your customer does NOT have to have a Paypal account for you to get paid this way.

https://www.paypal.com/nz/webapps/mpp/home

Stripe

Get yourself setup on Stripe stat, it’s simple and fairly instant to do so and offers a lot of options for NZ businesses. You will need a website so that Stripe can verify your business but they are being a bit more flexible about that in recent times and will accept a Facebook page link or another Social page as proof.

Stripe Invoice

Similar to Paypal, you can easily create invoices and receive payments online. You can add your own branding and customise to ensure it meets NZ’s GST requirements for a Tax Invoice.

https://stripe.com/docs/billing/invoices/create#without-code

Stripe & PayNow

Download the PayNow app, connect your Stripe account and you can charge any amount using your mobile phone. Brilliant!

Stripe & Xero

If you use Xero for your business you can add Stripe as a payment service and accept online payments by adding a Pay Now button onto your invoices.

When you add Stripe, Apple Pay is added as a payment option for online invoices as well.

https://central.xero.com/s/article/Stripe

Know of any other Apps or providers we should include here? Please comment below with the details.

And if you need to get your online payment sorted fast, then feel free to get in touch